- #Best personal finance for mac how to#

- #Best personal finance for mac Pc#

- #Best personal finance for mac download#

- #Best personal finance for mac free#

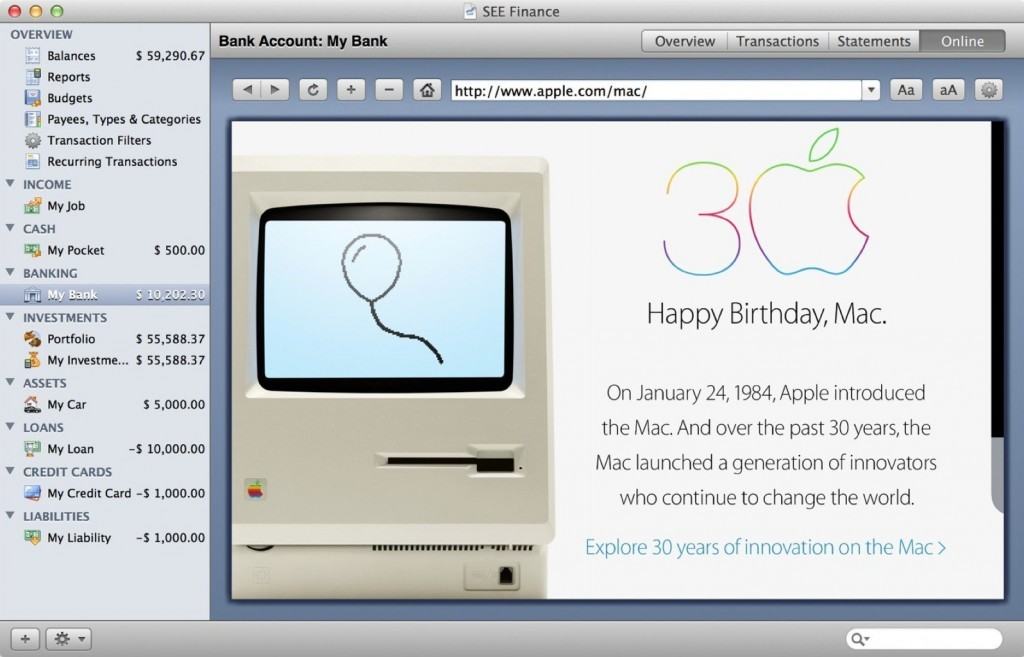

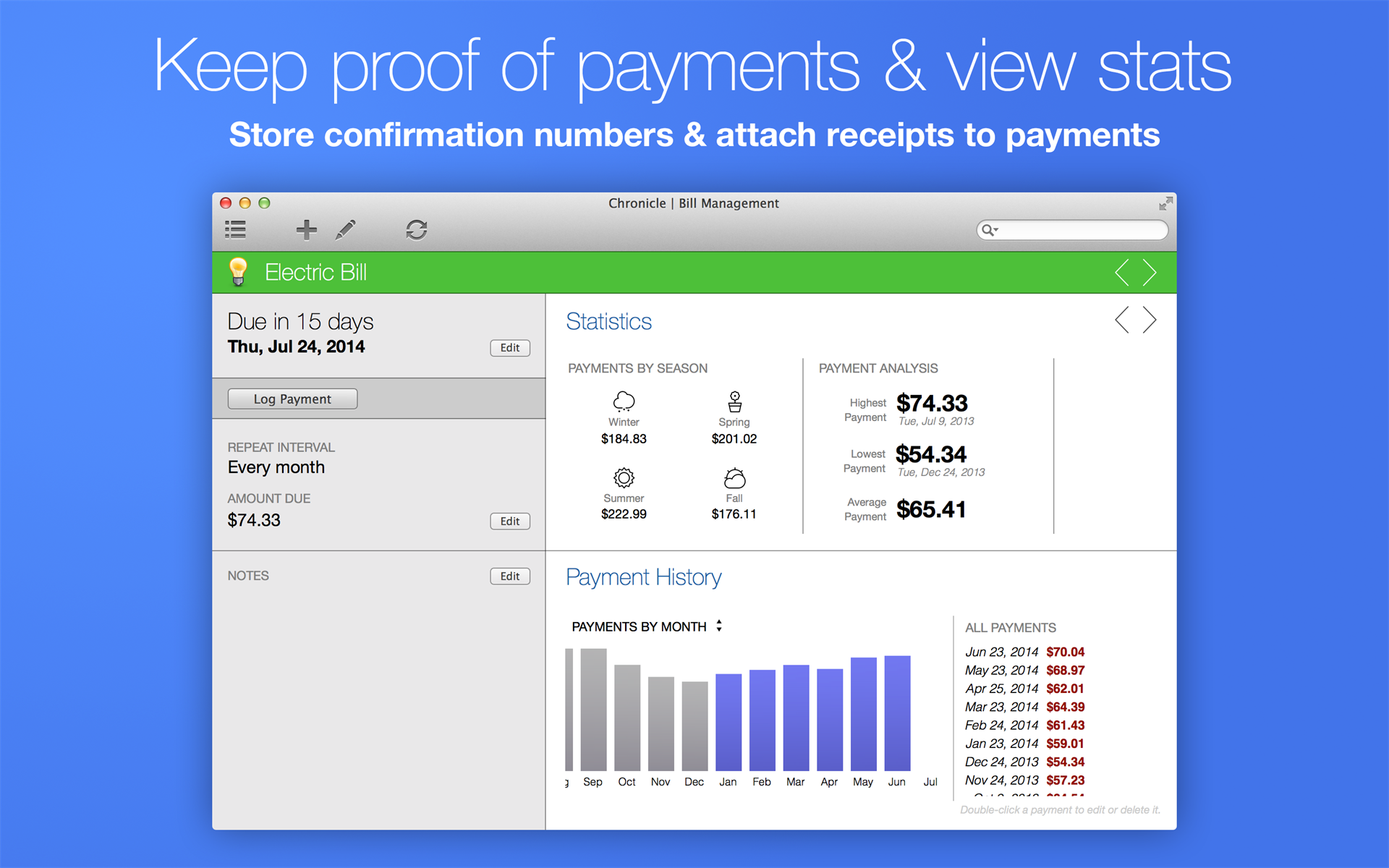

In short, a personal finance app's dashboard can either provide a quick look at your money situation or serve as a springboard to a deeper financial study. Click your credit score in Credit Karma to learn what contributes to it and how it's recently changed. Click a checking account balance in Mint, for example, to go to the account's register. You may be able to set goals and gauge your progress at meeting them, as well as see live updates on your investment portfolio if markets are open.īasically, this overview shows you snippets and highlights of the data analysis these services do behind the scenes (with options to dive deeper). You see charts and graphs that tell you, for example, what your income is versus your spending, and how you're doing on your budget. Sometimes, the dashboard is the only screen you need to see, because it displays the most pertinent information about your financial situation, such as your account balances and pending bills. Quicken's dashboard lets you see your income and expenses.Įvery service reviewed here has a dashboard, or home page, that you see when you first log in. This information can also be helpful when tax preparation time rolls around.

If you're conscientious about this, you'll see charts and reports that accurately tell you where you're earning and spending your money. Most personal finance apps guess the appropriate categories, but you can always change it-and you can split transactions among different categories. For example, transactions need to be correctly categorized as income (salary, freelance payment, and interest, for example) and expenses (food, mortgage, utilities, and so on). Once you import a batch of transactions, you will probably spend some time cleaning up the data. Typically, you simply enter your login credentials for those financial sites, though occasionally you have to provide additional security information.

#Best personal finance for mac download#

That is, you can download cleared transactions and other account data from your banks, credit card providers, brokerages, and other financial institutions, and see all of it neatly displayed in the applications' registers. For example, most of them support online connections to your financial institutions.

Critical ConnectionsĪll the applications we reviewed have new features, but they share common characteristics. Many are free, and the rest are reasonably affordable. There are many websites and desktop apps that help you understand your personal finances so you can make better, more informed decisions about spending. More than ever, you need to keep a close eye on your income, expenses, budget, and investments. After all, no one can accurately predict where we’ll be in a month, six months, or a year. We're a year and a half into the COVID-19 pandemic, and tens of thousands of Americans are still struggling with the hit to their personal finances. So, it’s important to know where you stand with your money, whether or not you’ve been affected so far. Since 1982, PCMag has tested and rated thousands of products to help you make better buying decisions. ( See how we test everything we review (Opens in a new window).)

#Best personal finance for mac how to#

#Best personal finance for mac Pc#

How to Record the Screen on Your Windows PC or Mac.How to Convert YouTube Videos to MP3 Files.How to Save Money on Your Cell Phone Bill.

#Best personal finance for mac free#

0 kommentar(er)

0 kommentar(er)